This month started with President Trump’s tariff announcement sparking worries about trade wars, a weak dollar, and a possible recession. However, since the April 8 low, the S&P 500 has staged a rally, climbing 11%, after the Trump Administration signaled its willingness to de-escalate the tariff competition, and Beijing responded in kind. Add in a Q1 earnings season delivering more upside surprises than expected, and suddenly, optimism is making a comeback.

It’s still too early to call it a full recovery, but if momentum holds, this could turn into a self-sustaining rally, which will offer plenty of opportunities for investors to maximize their income.

One popular way of boosting portfolio income, whether stocks go up or down, is investing in dividend stocks. The best dividend stock offers a combination of reliable payments, high yields, and share price growth – sound attributes for any income stream.

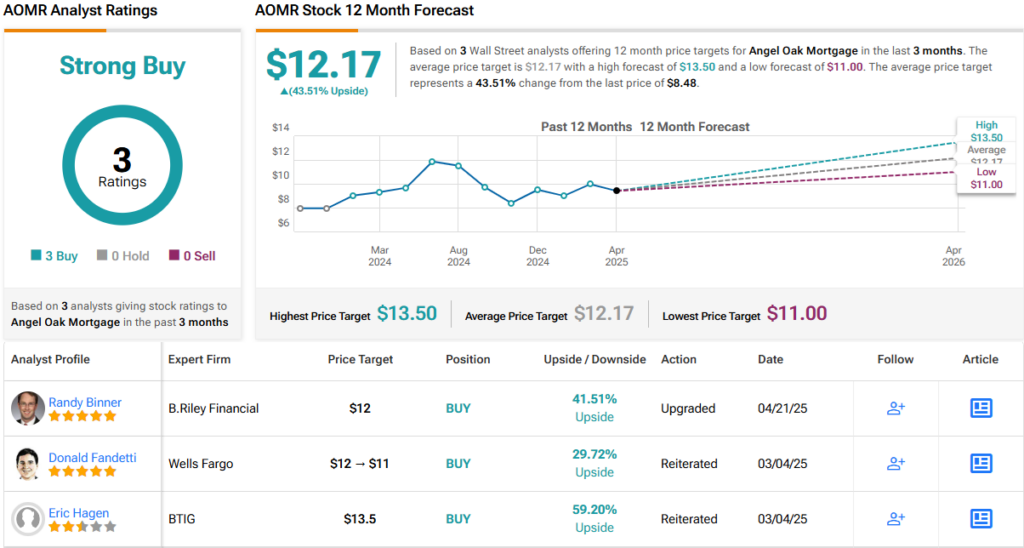

Wall Street analysts are on board, suggesting two strong dividend stocks with yields north of 14%. According to the TipRanks database, both stocks also offer a solid double-digit upside potential over the next year. Let’s dive in and take a closer look.

Angel Oak Mortgage (AOMR)

The first stock we’ll look at is Angel Oak Mortgage, a real estate investment trust (REIT), whose main business thrust is in the acquisition of first-lien non-QM loans and other mortgage-related assets from the U.S. mortgage market. Through these investments, Angel Oak has built and maintains a portfolio capable of generating attractive risk-adjusted returns for its shareholders, returns that are realized through cash distributions – dividends – combined with capital appreciation. The company’s key strength is its ability to maintain these returns across interest rate and credit cycles.

Angel Oak is an externally managed REIT, and is affiliated with the larger company Angel Oak Capital Advisors LLC, an alternative credit manager that counts a vertically integrated mortgage origination platform among its subsidiary assets. Through this connection, Angel Oak Mortgage REIT has connections to all aspects of the mortgage business, from sourcing and acquiring loans, to allocating assets and managing the portfolio. The connection with Angel Oak Capital Advisors provides a key advantage for the mortgage REIT.

As noted, Angel Oak Mortgage REIT is committed to strong capital returns, particularly to the dividend. The company last declared the dividend payment on February 6 of this year and paid it out on February 28, at a rate of 32 cents per common share. At that rate, the dividend annualizes to $1.28 per share and gives a powerful yield of 15%. This most recent declaration marked the 10th quarter in a row for the 32-cent dividend payment.